Digital feature: long read

Digital transformation: where now for food processing firms?

As Siemens head of food and beverage Keith Thornhill notes, industry 5.0 is fast becoming the latest trend and buzzword, but most businesses are still playing catch up with industry 4.0 adoption.

This is down to a number of factors, but most recently manufacturers across the industry are recovering from the pandemic and re-connecting the dots in developing methods for interconnecting new technologies improving efficiencies and productivity to meet new challenges. There is still much work to be done, he says.

“This just means that our industry needs to buckle up and accelerate the adoption of technology and lay the foundation before considering latest technologies like 5G,” Thornhill continued.

“As we take a closer look at digitalisation, one thing is clear: the central role of connectivity. Whether you are a large manufacturer or a small business, connectivity remains at the centre of technology transformation. And the core of this digitalisation is how Edge or Cloud can help operators gather data on their operations to gain valuable insight on their operations.”

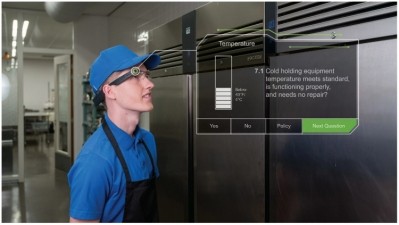

Thornhill described the pillars of industry 4.0 as automation and efficiency, while industry 5.0 will focus on robotic and smart technologies. Yet, the food and drink industry continues to innovate to use technologies like 5G, wearables and augmented reality (AR).

Two sides to the coin

Either way, both sides of the innovation coin remain focused on leveraging the Internet of Things (IoT) and big data.

“Today’s factories, whatever their size, are becoming huge data centres with great potential for collecting valuable insights on any area of factory operations, from production through-puts to machine usage, availability and set-up,” Thornhill continued. “And with this, manufacturers are (gradually) increasingly understanding the need to process this production data on an even larger scale.”

“Recent research by Siemens in the UK and Ireland found that 81% of food and beverage manufacturers are exploring more ways of capturing, managing and analysing production line data. But despite high uptake and good intentions, just 38% of manufacturers agreed that they had ‘somewhat’ achieved data maturity.

“The research also showed that manufacturers have clear strategic priorities, with over half focusing on delivering quality, 44% focused on cost reduction and 37% focused on agility.”

As Thornhill described it, the key to achieving these strategic goals is to take a holistic approach to digitalisation, connecting real-time data from across the factory floor and presenting it accessibly so that progress can be measured and managed.

Food for thought: The future of the food industry, Columbus

The past two years have been a rollercoaster for the food and drink industry. Today’s consumers have a greater awareness of wider global issues and want their food to not only be exciting, healthy and nutritious, but sustainable, ethical and environmentally-friendly. There are also regulatory standards to meet, allergens to minimise, waste to manage, margins to increase and the need to make supply chains more resilient in the face of unpredictability.

The best way to overcome these challenges is to transform your food business. We've seen technology such as:

- Robotics and automation ensuring quality while keeping labour costs low

- AI giving food manufacturers, processors and distributors in-depth insights into their process and machinery performance

- Drones allowing damaged crops to be quickly identified and tended to

But it’s about more than just implementing technology – you need the right digital strategy in place and buy-in across your business if you want to succeed. In our report, we assess the state of the food industry and predict what it could look like in the future.

We cover:

- The rising consumer and technological trends, and how the top players in the food industry are adapting their operations

- The importance of choosing the right technology for your specific needs – for example, solutions that are tailored to the food industry

- Business value and why food businesses need to look beyond system implementations and innovation projects if they truly want their change/transformation to deliver long-lasting, business-wide benefits

“As the industry slowly adapts industry 4.0 it cannot ignore industry 5.0. The former allows machines in the workplace to get smarter and more connected, the latter is aimed at merging the cognitive computing capabilities with human intelligence and resourcefulness in collaborative operations,” he concluded.

“Technology like 5G could become the enabler and a boost to digitalisation, however, the industry still needs to start with laying the basic foundations in their factory floors.”

Standardised approach

While businesses at the forefront of the digital revolution are constantly marching forward with the latest advances in digital technology in the factory, there are still many companies who have yet to put the first foot on the ladder of digital transformation.

For those that have, the question now is whether the systems that they have installed in the past are now fit for purpose in this rapidly evolving landscape. One such example was Swedish brewer Åbro Bryggeri, who approached CloudSuite Food & Beverage to help replace its aging ERP system.

“We have developed our ERP system in-house for many years, and saw that the competence to maintain the solution risked disappearing and that operating costs would increase,” said Björn Ainemo, chief financial officer at Åbro Brewery.

“So we started looking for a new suitable standard solution on the market that we could grow with, and Infor stood out because the solution was configured for our industry and suited many of the tasks we wanted to solve. With Infor, we also get more B2B functions we do not have today in a complete solution instead of independent digital islands.”

Rather than rely on disparate systems that will one day no longer receive support from the few people who still understand how they work within the business, Åbro Bryggeri have implemented what they hoped was a future proofed solution for their needs.

It also adds a layer of simplicity to proceedings, taking away the unneeded workload of a system run completely in house and instead outsourcing it to someone else to run.

“We now have a solution adapted for the future, such as our e-commerce where customers will be able to place orders directly in the system, which is not possible in our current solution,” said Anne Lageson, IT manager at Åbro Bryggeri.

“As Infor's solution runs in the cloud, it simplifies things for the IT side where we do not need to have any hardware in place. Updates are ongoing and the software is being developed, so even for our industry, we see the cloud as the future to simplify everyday life.”

Sustainable investment

What is undeniably at the core of any digital transformation within a food and drink business is the use of data. Once a manufacturer can identify just what goes in and out of the factory at a granular level, then they can further control efficiencies – from the obvious areas of reducing giveaway and detecting contaminants, to maintenance and energy usage.

Energy is an area that has garnered more and more attention in recent years, spurned by a consumer base that has become increasingly worried about how their actions, and the actions of business, impact the Earth.

Roel van Poppel, chief executive of AtSource, Olam Food Ingredients (OFI), explained that the bulk of its carbon footprints are made up of Scope 3 emissions, so reducing them is key to achieving net-zero.

“But they are also extremely complex to quantify and the area which businesses have least control over,” he added. “If you can’t see where your emissions are coming from then how can you achieve your reduction targets?”

“Accessing the granular data needed to monitor Scope 3 emissions requires looking at the carbon footprint of a bag of cocoa or coffee for example, on its journey through transport and processing, all the way back to the source – the farm where the beans were grown.”

Data collection

In OFI’s example, data is collected on the ground from 6,000+ enumerators across its cocoa, coffee, nuts, spices and dairy supply chains and fed into its sustainability insights platform AtSource.

“AtSource allows us and our customers to track environmental (as well as economic and social) metrics from farm to factory, including the emissions linked to land-use change, fertiliser and pesticide use, irrigation, and for some products, the amount of carbon sequestered in soil and trees,” Poppel continued.

“We recognise the challenge of tackling Scope 3 emissions, but with the demands on businesses to account for their carbon only getting stronger, the need for transparent, traceable supply chains is more vital than ever.

“The granularity of the data and visibility into the good and bad in our supply chains means AtSource is positioned to support sustainability reporting and inform meaningful action to fast-track our journey together towards net-zero.”

Food and drink firms can’t ignore the progress being made towards digitalising factories. Whether you like it or not, demands from both customers and consumers to be more agile and on top of every variable in the supply chain in this digital age will force the hand of many.

But with firms playing catch-up, there is the risk that even the most pro-active firms could be left behind if they aren’t on the pulse of this digital revolution. What remains clear is that those adopting these new technologies will have a firmer foothold in the food and drink landscape now and into the future.

How digital technology can cut costs and boost efficiency: Free webinar

Time is running out to book your space at our upcoming webinar on 21 June 2022 exploring how technology can allow manufacturers to do more with less, using less expensive resource and getting more from efficient and productive machinery.

This one-hour event, sponsored by Siemens, will help manufacturers just embarking on their journey answer the question, ‘where do I start’ and assist processors who have already started down the past in determining the next step for their business.

The webinar will also go over just what the digitalising process involves, how expensive, disruptive and time-consuming it is and how small businesses can benefit as much as larger companies with legacy systems.

Hosted by Food Manufacture editor Rod Addy, this webinar can help guide you through these questions, supported by practical wisdom from manufacturers in the field.

Scheduled speakers include Wyke Farms production manager Pete Hooper, Siemens Digital Industries finaincing partner Carolyn Newsham and Siemens head of food and beverage Keith Thornhill.