Digital feature: long read

How are food manufacturers tackling waste management?

Inflation is at a 30-year high in the UK, while Brexit and the pandemic have challenged supply chains and accelerated a critical shortage of workers and drivers.

Global supplies of energy and raw materials were facing a squeeze before Russia invaded Ukraine, prompting forecasts to turn from inflation to hyper-inflation.

And, four months on from COP26 in Glasgow, the latest report from the UN Intergovernmental Panel on Climate Change finds global action is needed by the end of this decade to avert disaster.

Facing this confluence of challenges, waste is simply no longer an option for food manufacturers.

Scope 3 GHG emissions

Steering efforts to address the issue is environmental charity WRAP, which last month announced it would publish a measurement framework for Scope 3 greenhouse gas emissions (GHG) reporting in food and drink this year.

Its plans were unveiled at the annual meeting of the Courtauld Commitment 2030, the charity’s voluntary agreement setting targets for UK food chain stakeholders to reduce food waste, GHGs and water stress.

WRAP operates a UK Plastics Pact, Water Roadmap and, in partnership with IGD, a Food Waste Reduction Roadmap regarded as key to the UK meeting the UN Sustainable Development Goal 12.3 of halving food loss and waste by 2030.

The Roadmap’s 2021 report identifies an annual 250,000 tonnes of food worth £365m saved from waste, up to 670,000 tonnes of GHG emissions avoided, and redistribution of surplus food equivalent to 145 million meals.

Producers and manufacturers signed up to the Roadmap have quadrupled to 209 since 2018. That includes 130 businesses achieving an 18% reduction in food waste by participating in whole chain food waste reduction plans and committing to its Target, Measure, Act approach.

Manufacturers making strides

Dawn Meats is signed up to the Roadmap and WRAP’s Meat in a Net Zero World initiative, as well as a strategic partner for its recent Food Waste Action Week.

“Our approach is to measure consumption, identify opportunities for optimisation, set targets, regularly monitor progress and leverage appropriate frameworks,” says Gill Higgins, Group head of CSR and sustainability. “We are committed to reducing all forms of waste across our business, and by adopting a LEAN approach, we have been a zero waste to landfill business since 2016.”

Food waste as a percentage of finished product was trimmed down to 0.24% in 2020 through valorisation, utilisation and lean processing.

Animal byproducts

With animal by-products (ABPs) designated unfit for human consumption, the Group is processing Category 1 for energy production such as biodiesel, Category 2 for anaerobic digestion into energy or compost, and Category 3 for ingredients going into pet food, oleochemicals, biodiesel and fertiliser.

“The animal processing industry have become leaders in resource optimisation and in creating circular business models, as ABPs are utilised upstream of the business and this organic material is not considered waste,” says Higgins.

Dawn Meats and Dunbia are also installing new protein and fat recovery technology supplied by Elemental, expected to capture up to 15% more human edible food products, with a meat equivalent of 30-40kgs per carcase.

The recovered proteins and fats will become fully traceable, sustainable ingredients for use in products such as ready meals, gravy and soup, while the reduction in waste will also help the Group reduce transport emissions.

Group CEO Niall Browne says the technology is expected to deliver 20% of its annual Scope 1 reduction target, towards a 58% overall reduction in Scope 1 and 2 emissions by 2030.

Increased yields, complete traceability

Dean Hislop, chief executive at Elemental, says: “We can increase yields per animal, essentially delivering nose-to-tail use, and the products created offer complete traceability from field to fork.

“For meat processors, we not only help reduce waste and the carbon footprint associated with waste disposal, but we also open up new revenue streams. Instead of representing a cost, these are new sustainable products which are sold into existing supply chains.

“We’re receiving a lot of interest from food and agricultural groups for either the use of technology or the supply of our end protein, fat and fertiliser products.”

Princes Group

Another Roadmap signatory, Princes Group, has recently set targets under its GreenGoals initiative from a 2018/19 baseline to cut general waste by 30%, halve food waste and become carbon neutral by 2030.

“Since 2018/19, we’ve seen a reduction of total waste of 16% at a Group level and food waste of 3% as a result of challenging ourselves harder on reducing waste at source, and a focus on the waste generated at each stage of the production process,” says David McDiarmid, corporate relations director at Princes Group.

“We set a target a long time ago for no waste to landfill and our UK sites achieved this back in 2018, but we still have some areas to improve on internationally at our tuna and tomato sites.”

In the year to March 2021, of 69,456 tonnes of food waste generated across the Group’s global operations, 20,636 tonnes went into anaerobic digestion, 45,726 tonnes into animal feed and 202 tonnes to charities such as FareShare.

“We have a clear responsibility when it comes to waste management. Our interest comes from multiple sources. It’s a key part of being a responsible business, so it speaks to our sustainability agenda. It’s also a key compliance area. It's linked to commercial performance as it’s a cost issue, and increasingly it’s understanding our role in the circular economy we are moving to as a nation.”

Cake and dessert manufacturer BBF

As well as FareShare, cake and dessert manufacturer BBF supplies its surplus food to Company Shop Group, to which it redistributed 55 tonnes of surplus food generating more than 140,000 meals in their first year of partnership.

“We have also developed a relationship with a biogas business, which has enabled us to use the screenings from our effluent plant to recycle this waste stream to generate energy,” says Mark Izzard, technical director.

“Where we have surplus that is not able to enter the human food chain, we divert this to animal feed and we recently selected a partner that is working with us across all of our UK bakeries. We have also invested in dedicated handling equipment for this surplus, to ensure it is identified as animal feed and makes it as easy as possible for the bakeries to handle in the production environment.”

Reducing waste through quality controls at each step of production is also a focus for BBF, which has achieved zero waste to landfill since 2017.

“Throughout our bakeries, we’ve provided colour coded food waste and surplus bins and have rolled out comprehensive training to educate and support our employees on reducing food waste and surplus,” says Izzard. “Further to this, our team has worked hard to enhance stock control procedures to proactively manage raw material shelf life, adopting a scientific approach when managing our work in progress materials.”

MAP is widely recognised as an effective technology proven to extend the shelf-life of packaged foods and reduce food waste

Extending shelf-life can be an important tool in tackling food waste, says Neil Hansford, food packaging and cryogenic freezing expert at Air Products, recommending the use of Modified Atmosphere Packaging (MAP) solutions alongside improved temperature control throughout the logistics chain.

“MAP is widely recognised as an effective technology proven to extend the shelf-life of packaged foods and reduce food waste,” says Hansford. “MAP’s gas mix creates a protective atmosphere around the food to keep it fresher for longer. It slows down the product aging process to reduce colour loss, odour and off-taste resulting from product deterioration.”

MAP can be combined with cryogenic freezing to extend the life of products destined for chilled counters and maintain supply at times of high demand or seasonal bottlenecks.

Products can be cryogenically frozen and packed, retaining the quality, appearance and shelf-life of a standard MAP chilled product after thawing.

Shelf-life, quality, food safety

“Tackling food waste is an issue throughout the whole supply chain,” says Hansford. “But, as MAP demonstrates, there are solutions that can not only increase the shelf-life of products, but also provide food manufacturers and customers alike with a number of other product quality and safety benefits too.”

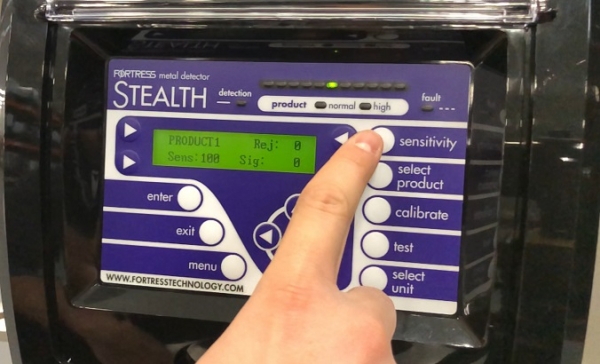

Investment in efficient automation and quality control processes is an easy way for manufacturers to reduce food waste, says Phil Brown, managing director of Fortress Technology.

“High-speed, multi-line food packing operations can produce huge amounts of unnecessary waste,” he says. “Even a few grammes surplus in every food pack can rapidly equate to thousands of pounds per month.

Accurate and consistent weighing

“By capturing sample readings by the millisecond, the high-end Raptor control system provides accurate and consistent weighing results which is a game changer for food factories concerned about product waste and giveaway. Using Raptor’s digital data capture feature, manufacturers can pinpoint upstream operational deficiencies, including overfilling of packs, processing and packaging waste.

“The increases in energy costs, CO2, transportation and labour make it even more imperative to consider the whole waste picture and how precision processing can protect profit margins too. Implementing time-saving and digital processes, automated calibration of machinery and better detection systems can all help to acquire financial savings and tackle this war on food waste.”